UK Form CG34 2020-2025 free printable template

Show details

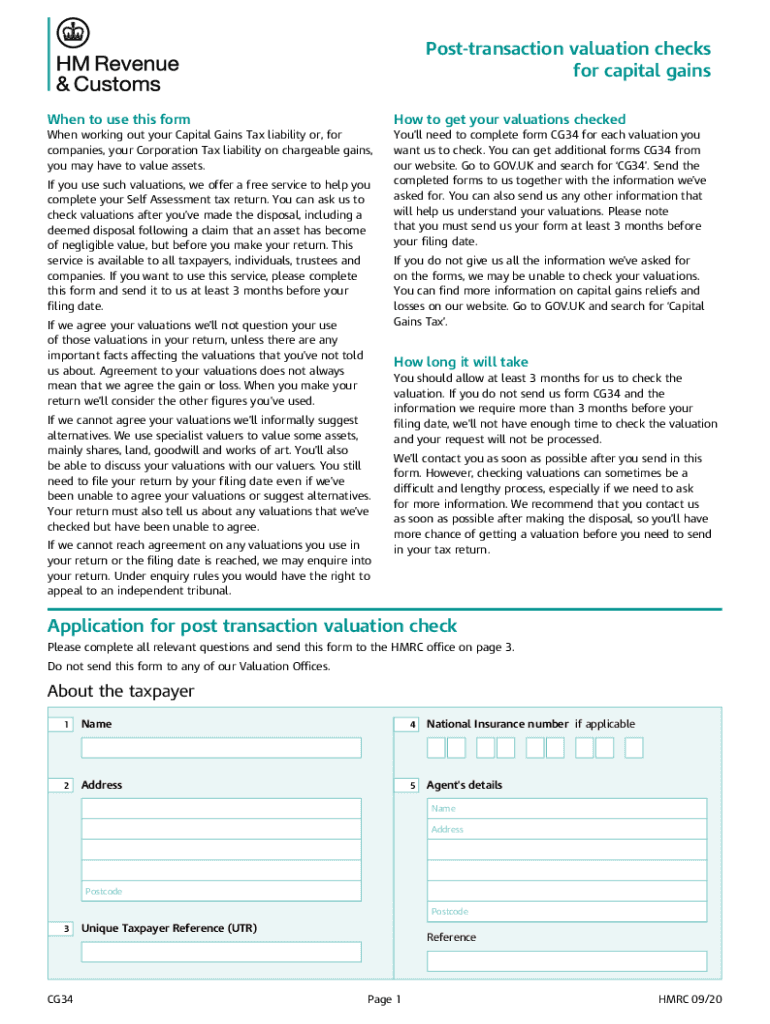

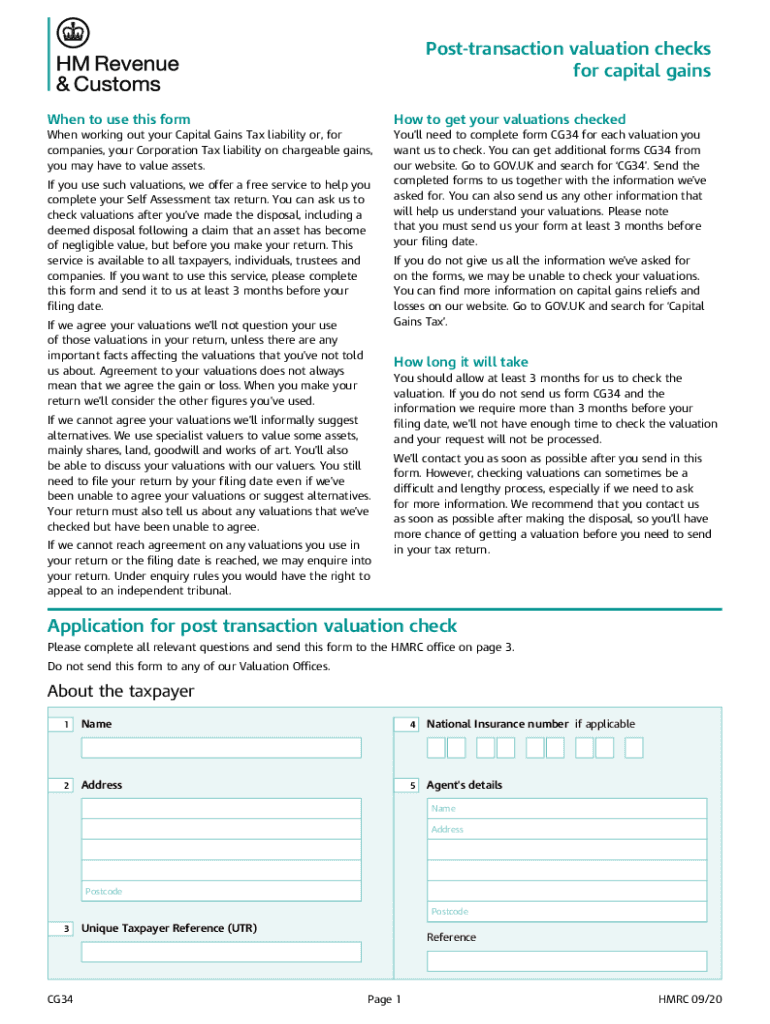

Posttransaction valuation checks for capital gains When to use this form to get your valuations checkedWhen working out your Capital Gains Tax liability or, for companies, your Corporation Tax liability

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uk form capital gains

Edit your cg34 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cg34 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

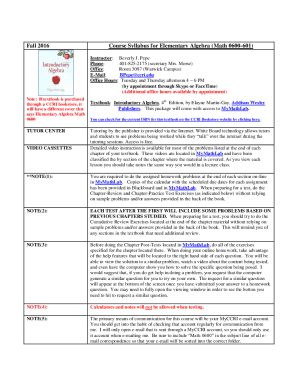

Editing cg34 form download online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit uk cg34 printable form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

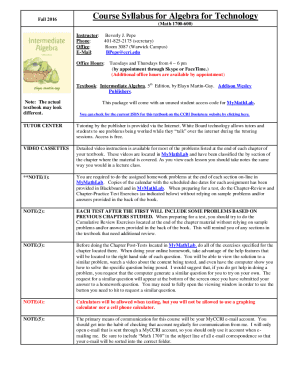

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

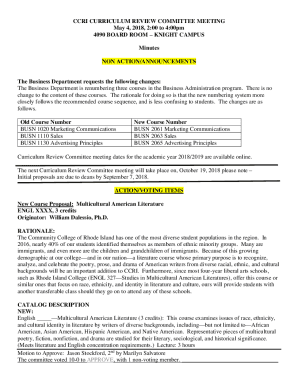

UK Form CG34 Form Versions

Version

Form Popularity

Fillable & printabley

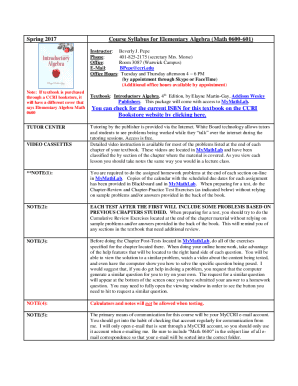

How to fill out uk cg34 template form

How to fill out UK Form CG34

01

Obtain the UK Form CG34 from the official HMRC website or your local tax office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Clearly state the reason for your claim and provide any necessary details.

04

Provide supporting documentation as required, such as evidence of your circumstances.

05

Check the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form by post to the address specified in the guidance notes.

Who needs UK Form CG34?

01

Individuals or representatives who are seeking a reconsideration of a tax decision made by HMRC.

02

Those who believe there has been an error or miscalculation in their tax assessment and wish to appeal.

Fill

cg34 valuation

: Try Risk Free

People Also Ask about cg34 printable

What expenses are allowed for capital gains tax?

Deductions you can make from capital gains tax Private residence relief. Costs of buying and selling the property, including stamp duty, solicitor fees, and estate agent fees. Eligible costs of improvements, for example an extension or new kitchen.

What is a CG34 form?

Fill in form CG34 if you've disposed of assets and need their valuations checked and you're: an individual working out your Capital Gains Tax liability. a company working out your Corporation Tax liability.

What is a post transaction valuation check?

It is possible to ask HMRC to check valuations (for capital gains tax) after a disposal has been made but before you submit the relevant tax return. This service is available to trustees, companies and individuals.

What is a property valuation for CGT?

CGT must be reported in your income return and tax paid on any gains, being the difference between the purchase and sale price. A capital gains tax property valuation report is used to determine the increase or decrease in the value of the property and calculate the taxable capital gain or capital loss.

What is a valuation for tax purposes?

For capital gains tax purposes, a valuation is used to set the cost base. While it is an ATO requirement to have a capital gains tax property valuation, it's also beneficial for you as an investor to take advantage of an increased cost base. The higher the cost base, the less capital gain you'll have to report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cg34 form?

There is no specific CG34 form that can be universally defined. The term "CG34 form" does not have a widely recognized meaning or association. It is possible that it may refer to a specific form used in a particular context, such as a government or organizational form, but without more information, it is difficult to provide a precise answer.

Who is required to file cg34 form?

The CG34 form, also known as the Verification of Eligibility for Exemption Under IRC Section 110, is used by entities that are claiming exemption from the federal withholding tax on certain types of income. Specifically, it is required to be filed by foreign governments, international organizations, and certain diplomatic personnel.

How to fill out cg34 form?

The CG34 form is an HM Revenue and Customs (HMRC) document used in the United Kingdom for reporting capital gains. To fill out the form, follow these steps:

1. Obtain the CG34 form: You can download the form from the official HMRC website or request a paper copy from HMRC.

2. Provide personal information: Fill in your personal details, including your name, address, telephone number, National Insurance number, and Unique Taxpayer Reference (UTR) if applicable.

3. Reporting period: Mention the tax year or accounting period for which you are reporting capital gains.

4. Capital gains information: Provide details of each capital gain on a separate page or schedule if necessary. You will need to include the following information for each gain:

- Description of the asset or investment

- Date of acquisition (day/month/year)

- Date of disposal (day/month/year)

- Proceeds from the disposal (sale price)

- Cost of the asset (purchase price)

- Incidental costs of acquisition or disposal (such as legal fees)

- Any allowable deductions, reliefs, or exemptions

5. Calculate the gain: Subtract the cost and incidental costs from the proceeds to calculate the gain for each asset.

6. Additional sections: Depending on the nature of your gains, you may need to complete additional sections, such as sections for share matching, non-business depreciation, chattels, etc. Refer to the instructions provided with the form or consult HMRC guidance to determine if any additional sections apply to you.

7. Declaration: Sign and date the declaration section of the form, confirming that the information provided is correct and complete to the best of your knowledge.

8. Submitting the form: Once completed, you can submit the CG34 form to HMRC either online (if you have registered for online filing) or by mailing the paper copy to the address mentioned on the form. Make sure to keep a copy for your records.

It is advisable to consult an accountant or tax professional if you have complex capital gains or if you are unsure about any aspect of the form.

What is the purpose of cg34 form?

The CG34 form, also known as the "Statement of Claimant or Other Person," is a legal document used in the United Kingdom for individuals or organizations to make a claim against the government or another agency for compensation or damages. The purpose of this form is to provide details of the claimant (person or organization making the claim), the background and reasons for the claim, the amount of compensation or damages sought, and any supporting evidence. It is typically used in cases where a person believes that they have suffered harm or loss due to the actions or negligence of a government authority or agency.

What information must be reported on cg34 form?

The CG34 form, also known as the Employee's Health Insurance Coverage Information Return, is used by employers to report information about health insurance coverage offered to their employees. The following information must be reported on the CG34 form:

1. Employer information: The employer's name, address, and employer identification number (EIN) must be provided.

2. Employee information: The form requires reporting on each employee who was offered health insurance coverage during the reporting year. This includes the employee's name, address, social security number or taxpayer identification number, and the months for which coverage was offered.

3. Health insurance coverage details: The form requires information on the type of coverage offered, such as whether it is self-only coverage or family coverage. It also requires information about the premium for the lowest-cost, self-only minimum value coverage offered by the employer.

4. Months of coverage: Employers must indicate which months they offered coverage to their employees. This includes reporting if an employee was offered coverage for the entire calendar year.

5. Safe Harbor: Employers can utilize a safe harbor to determine if the cost of their coverage is affordable for employees. If a safe harbor is used, the details of the safe harbor calculation must be provided on the form.

6. Additional details: The form may include other relevant information such as any transition relief or other applicable information requested by the IRS.

It's important to note that the CG34 form is used for informational purposes and does not need to be filed with the IRS. The information provided on the form helps the IRS determine whether an employer is subject to penalties under the Affordable Care Act's employer shared responsibility provisions.

How do I modify my uk form valuation in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your cg34 gains trial as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify cg34 valuation capital without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your UK Form CG34 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete UK Form CG34 online?

pdfFiller has made filling out and eSigning UK Form CG34 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is UK Form CG34?

UK Form CG34 is a form used to apply for the relief from Capital Gains Tax (CGT) on the disposal of certain assets, such as shares or property.

Who is required to file UK Form CG34?

Individuals or entities that have disposed of qualifying assets and are seeking relief or exemption from Capital Gains Tax must file UK Form CG34.

How to fill out UK Form CG34?

To fill out UK Form CG34, you need to provide personal details, details of the asset disposed of, the dates of acquisition and disposal, and any calculations related to the capital gains or losses.

What is the purpose of UK Form CG34?

The purpose of UK Form CG34 is to formally request Capital Gains Tax relief and to supply the necessary information for HM Revenue and Customs (HMRC) to assess eligibility.

What information must be reported on UK Form CG34?

UK Form CG34 requires reporting information such as the taxpayer's details, descriptions of the asset, dates of ownership and disposal, and details of any relief being claimed.

Fill out your UK Form CG34 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form cg34 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.